Competently parallel task fully researched data and enterprise process improvements.

Veterans Have Earned Affordable Homeownership

American veterans worked hard and put their lives on the line to protect their country and their fellow citizens. During their commitment and dedication to serving our country, our nation’s finest earn access to a variety of programs to help them ease back into civilian life after their service ends.

To assist veterans and active servicemen in obtaining the American dream of homeownership, the Department of Veterans Affairs offers a special type of home loan product exclusively to veterans and active servicemen: the VA home loan.

VA loans often have many benefits over other mortgage loan types for those who are eligible–including the fact that they don’t require a down payment. Unfortunately, many veterans don’t utilize their VA loan benefit despite its tremendous value.

Shocking Statistics

Despite the fact that VA home loans are designed to make homeownership accessible and affordable for our nation’s veteran population, many veterans simply do not use them. Is it because they are unaware that the benefit exists or because they have heard negative–and usually false–‘facts’ about VA loans? No one knows for sure, but one thing is for certain: buying a home might become a reality for U.S. veterans if they explored the option of the VA loan benefit.

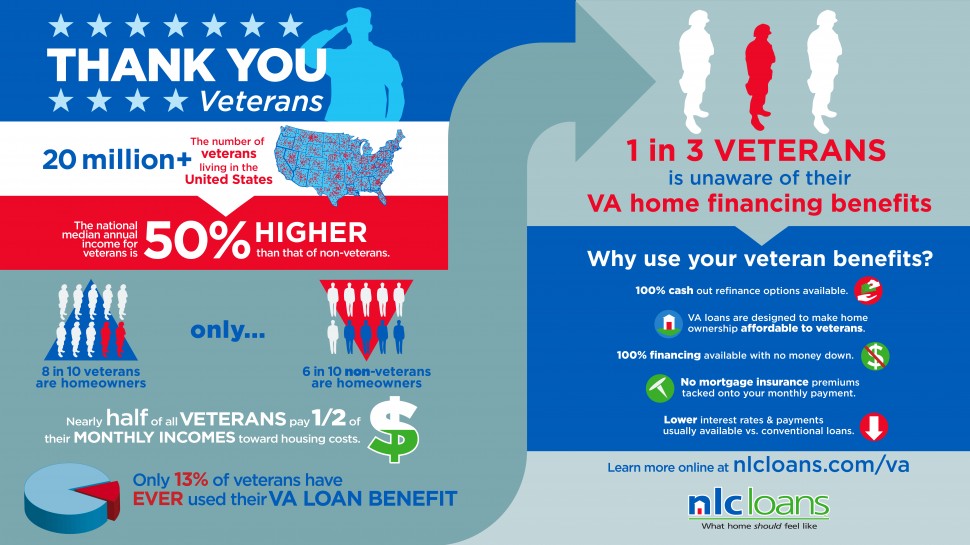

80% of the country’s veteran population are homeowners–compared with just 60% of non-veterans. This means that more veterans own homes than do non-veterans–and yet only 13% of veterans in the U.S. have ever utilized their VA loan benefit. Considering that nearly half of all veterans in America pay 50% (or more) of their monthly incomes toward housing costs, it’s only natural to wonder if they could be saving substantially if they were to choose a VA loan instead of another mortgage type or monthly rental payment.

What Are the Benefits of VA Loans?

No Down Payment

For those looking to buy a home with a VA loan, one of the most valuable aspects of VA loans that they don’t require a down payment. In fact, 100% of the home’s value can be financed with a VA home loan. While veterans do need to pay a fee to the VA upon loan closing (this fee helps to keep the VA home loan program funded for other veterans in the future), the fee is less than even a minimum down payment on any other loan type.

100% Equity Cash Out

For veterans who already own homes, refinancing with a VA loan allows for the opportunity of 100% equity cash out. This is something many homeowners find to be extremely valuable, especially when it comes to saving for college or retirement, making home improvements, or even paying off higher interest debt such as credit cards or installment loans.

Even if a veteran owns a home with another loan type, he or she can refinance with a VA loan and still take advantage of being able to access up to 100% of their home’s equity. No other home loan type offers this benefit.

No Mortgage Insurance Costs to Worry About

In addition to those great benefits, VA loans do not have any type of mortgage insurance premiums or private mortgage insurance costs. Even if the veteran purchases a home with a 0% down payment, there is no insurance cost to factor into the home’s monthly mortgage payment with a VA home loan.

Other loans require mortgage insurance premiums for any down payment of less than 20% of the home’s value. This fact alone has the potential to save veterans up to a hundred dollars a month–or more, depending on the value of the home purchased– on their mortgage payments.

Likely to Have Lower Interest Rates

Lastly, VA home loans typically have lower interest rates than do other loan types. This isn’t always the case, but in the majority of instances, eligible veterans are offered lower mortgage rates on VA loans than on conventional or FHA loans.

Author Credit:VA Loan Benefits